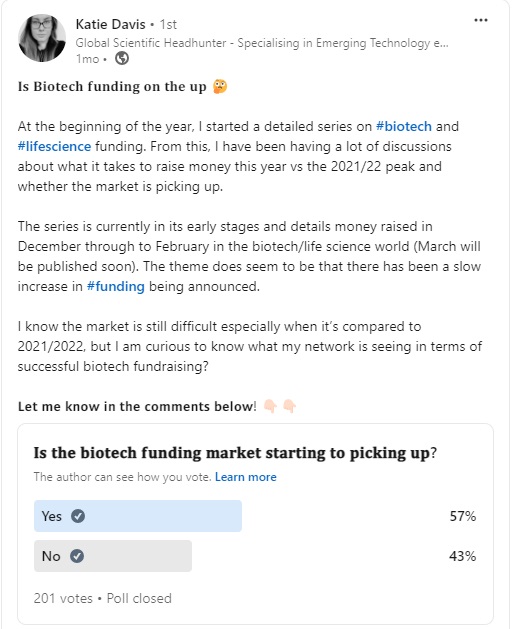

Recently, Director of our life science team Andrew Maddison posted a LinkedIn poll to find out what my network is seeing in terms of successful biotech fundraising rounds. Based on the insights in relation to that poll, and to follow up, I have put together some pointers to consider when fundraising in a more challenging biotech market.

Data and milestones:

Showcase tangible evidence of progress, milestones achieved, and user traction to instil confidence in your venture’s viability. This is one of the most common points I hear from people in the industry, investors want to know that they are investing in something with long-term viability!

Have a crystal-clear value proposition:

Emphasise the unique value your product or service brings to the market, address a specific pain point or need, and have a strong mission and objectives. Detail your product pipeline, target markets, competitive landscape, and revenue projections. Investors want to see a comprehensive plan that demonstrates the potential for success.

Have a compelling story:

Weave a compelling narrative around your journey, emphasizing the problem-solving nature of your venture and connecting emotionally with investors.

Know your market:

Be able to demonstrate a deep understanding of your target market, presenting compelling data and insights that highlight the potential for growth and scalability.

Have strong team dynamics:

Emphasize the skills, experience and cohesion within your team to assure investors that your venture is backed by a capable and dedicated group.

Financial viability and projections:

Present a clear and realistic financial model, demonstrating a path to profitability and a solid understanding of your business’s financial landscape.

Focus on science and innovation:

Highlight the scientific novelty and innovation of your technology or product. Provide evidence of efficacy and differentiation from existing solutions in the market. Investors in biotech are often drawn to breakthroughs with the potential to disrupt the industry.

Collaboration and strategic partnerships:

Collaborate with research institutions, academic centres, or industry partners to leverage resources, expertise, and credibility. Strategic partnerships and licencing opportunities can provide validation for your technology and help attract investors.

Seek early validation:

Generate proof of concept data through preclinical studies or clinical trials to demonstrate the feasibility and potential efficacy of your product. Early validation can significantly enhance investor interest and valuation.

Understand regulatory pathways:

Have a clear understanding of the regulatory requirements for bringing your product to market.

Mitigate risks:

Identify and address potential risks associated with your technology, such as regulatory hurdles, intellectual property challenges, or market competition.

Diversify funding sources:

Explore various funding sources, including venture capital, angel investors, government grants, and strategic partnerships. Diversifying your funding sources reduces dependency on any single investor or funding mechanism.

E.g. The National Institute of Health sets aside over $1.2 billion annually exclusively for small businesses

Target experienced investors:

Investors who have experience in your industry can provide valuable guidance and connections that can help you navigate challenges and take advantage of opportunities

Networking:

Attending industry conferences and investor events gives you more visibility with potential investors specializing in the biotech and healthcare sectors. In order to stand out, it’s important to create a compelling pitch deck.

If you’re a biotech startup looking for talent, or you’d like to learn more about our recruitment services, submit your vacancy and a recruitment consultant that specialises in your biotech field will be in touch shortly.

Alternatively, are you seeking advice on your next move? I’m here to help. Register with us today to schedule a confidential discussion about your career prospects.